As 2022 comes to a close, it's time to take a look back at the developments and trends that shaped the cryptocurrency market. From Terra Luna’s collapse to the bankruptcy of the third largest crypto exchange - FTX, the past year has been full of ups and downs for digital assets. In this year-end crypto recap, we'll review the key events and trends that defined the market in 2022, and offer insights into what we can expect in the coming year. Whether you're a seasoned crypto investor or just getting started in the world of digital assets, this report is designed to provide valuable information and analysis for anyone interested in staying up-to-date on the latest happenings in the crypto space.

What had we been through so far?

#1 The rise and fall of Terra Luna

Image Source: https://akm-img-a-in.tosshub.com/businesstoday/image

What are Terra, LUNA, UST and Anchor Protocol?

Terra is an L1 Blockchain similar to Ethereum and it uses LUNA as a native Blockchain coin. Do Kwon and Daniel Shin who are the Founder and Co-Founder of Terraform Labs, created this network in 2018. TerraUSD(UST) and LUNA are two sister coins on the same network.

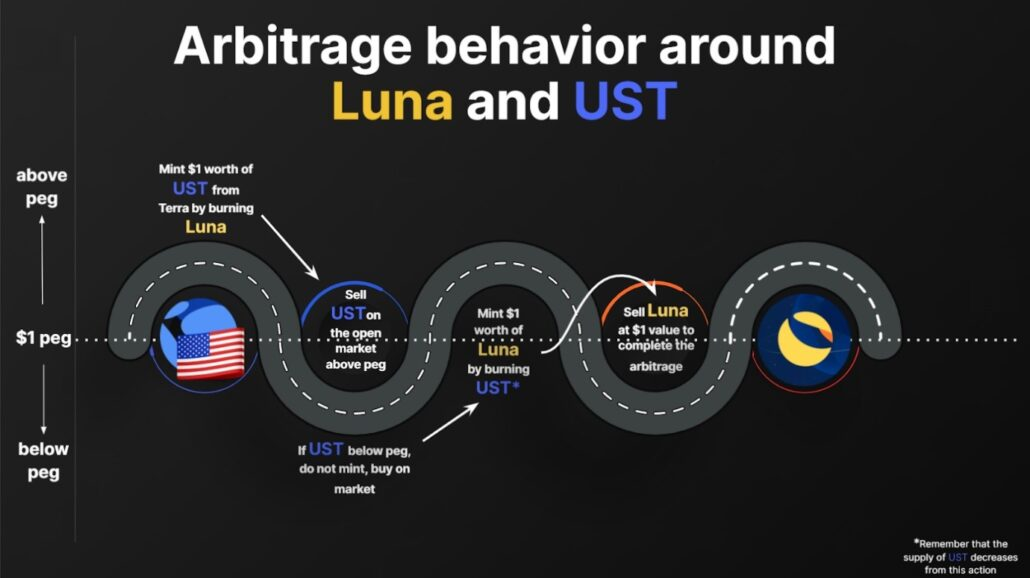

UST is an algorithmic stablecoin that is not backed by an actual US Dollar but instead, it is pegged to LUNA. The mechanism of algorithmic stablecoin like LUNA-UST is that to create UST, you have to burn LUNA or vice versa. Therefore, one UST could be changed to $1 of LUNA at any time for UST to retain its peg to the dollar. This mechanism has a problem that both LUNA and UST will crash once UST lost its peg to the dollar.

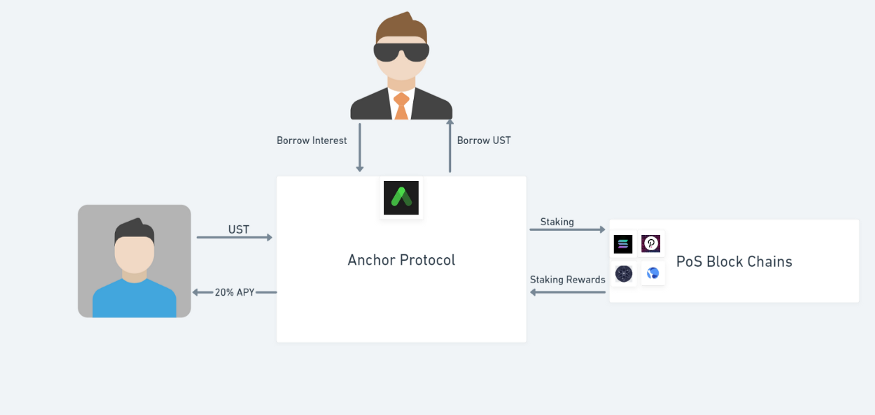

Anchor Protocol is a financial platform built on the Terra blockchain that allows users to earn passive income by depositing their assets and also provides borrowers with access to stablecoin loans that are backed by collateral.

The relationship between Anchor Protocol and UST

Image Source:www.medium.com/anchor-protocol

The mechanism among LUNA and UST

Image Source: https://www.drwealth.com/what-is-terra-luna/

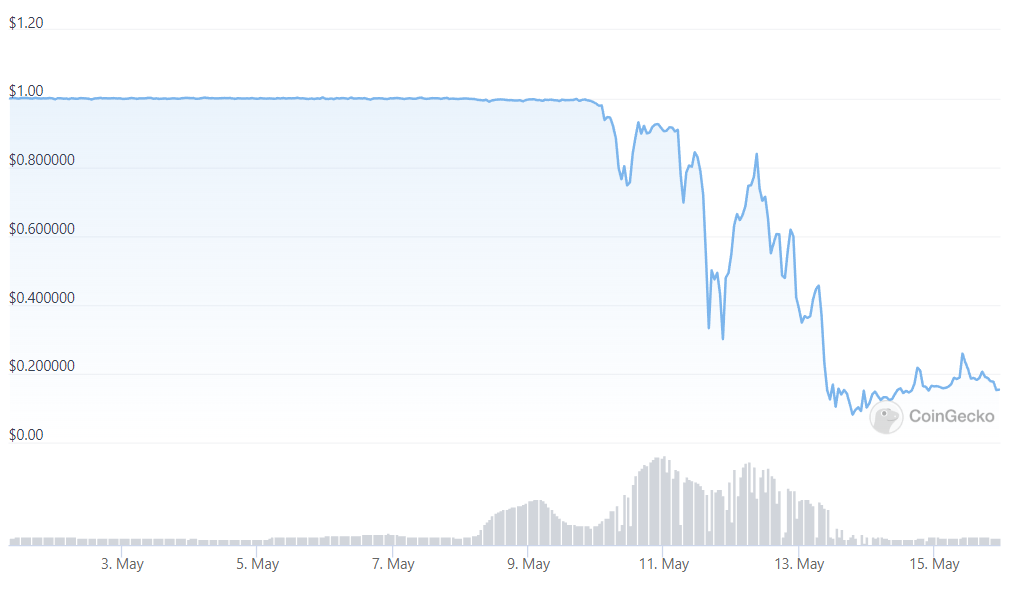

Here are some key events that caused UST to break its peg:

$150m of UST was removed from liquidity by Terraform Labs. (According to them, to be redeployed into another liquidity pool next week)

1 minute later, another wallet dumped $84m of UST.

Along the way “hundreds of millions worth were sold in mere moments, along with over $2 billion in withdrawals from Anchor Protocol, essentially a bank for UST.

Price of UST before and after the de-pegging

Source: https://www.coingecko.com/en/coins/terraclassicusd

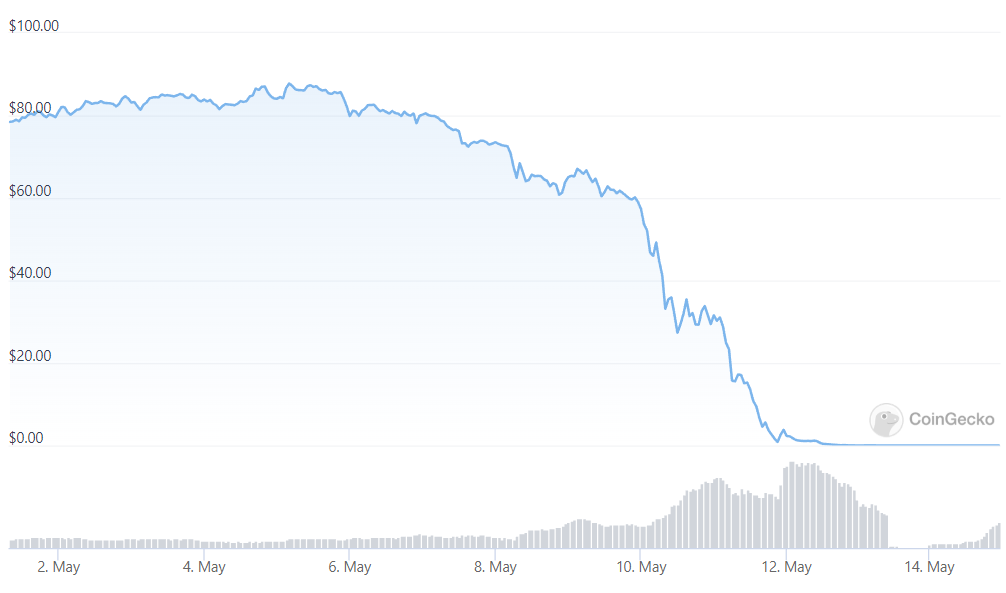

Price of LUNA during the de-pegging of UST

Source: https://www.coingecko.com/en/coins/terra-luna-classic

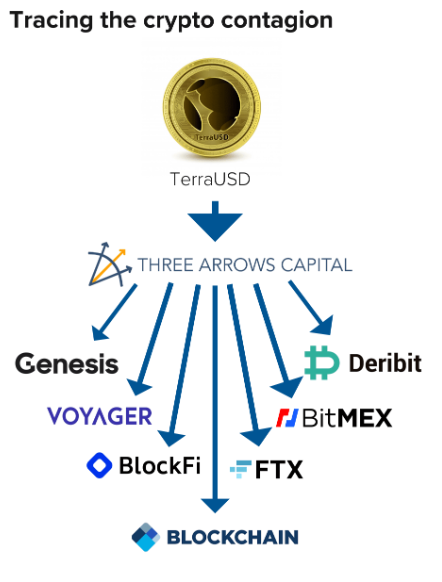

Domino effects of Terra Luna Crash:

Loss of $300 billion in value across the cryptocurrency space

Voyager and Celsius filed for bankruptcy

Three Arrow Capital (3AC) was forced into liquidation

Lessons learnt from Terra Luna Crash:

Nothing is too big to fail

The Terra LUNA incident proves to us that nothing is too big to fail. LUNA and UST were in the top 10 coin rankings in the cryptocurrency market before the crash. UST was the top 3 stablecoin with a market cap of around 18 billion US dollars.

Terra LUNA and TerraUSD market cap and price on 8th May 2022

Avoid the cult of personalities

Do not excessively admire someone just because of the skyrocketing token prices. LUNA gained over 2000% in a year doesn’t mean that it’s necessary to overly admire Do Kwon and Terra’s team.

Have a risk management and create a system to protect yourself

Never go all-in into anything because nothing is guaranteed in any financial asset either cryptocurrency or non-cryptocurrency assets. Have a rule for your investing system. For example, no token or coin goes over 15% of your portfolio. This might help to minimize the risk

Do not catch a falling knife

Do not even try to buy a dip when the coin is crashing, get out of the way quickly when it falls fast. LUNA crashed from $85 to around $.0001 within 10 days. It doesn’t matter how cheap you buy during the crash, you still lose your money all the way.

Beware of the risk of High-Yield Products

Anchor Protocol, a De-Fi protocol on Terra provided 20% of APY for UST deposits. In short, 20% is too good to be true for everyone and it is not sustainable. We all knew what happened next after Terra LUNA crashed, many people’s funds in Anchor Protocol suffered huge losses.

#2 The bankruptcy of 3AC

Image source: https://watcher.guru/news/post-terra-celsius-debacle

What is 3AC?

Three Arrows Capital (3AC) is a Singapore-based crypto hedge fund that managed about $10 billion in assets at one point. Su Zhu and Kyle Davies founded 3AC in 2012 and started with $1.2 million of capital.

A timeline of 3AC’s downfall:

In February 2022, 3AC invested about $200 million in LUNA in February 2022.

As mentioned above, Terra LUNA collapsed in May 2022, falling from around $80 to a couple of pence.

After the Terra LUNA crash, the creditors of 3AC asked for their cash back but the money had gone.

3AC team tried to pitch new investors and arrange a new loan with Genesis to save the company and pay the margin call of Deribit around June. Soon after, 3AC’s insolvency was widely reported.

On July 1, 3AC filed for Chapter 15 bankruptcy without knowing the whereabouts of the founders.

Image Source: https://www.cnbc.com/2022/07/11/how-the-fall-of-three-arrows-or-3ac-dragged-down-crypto-investors.html

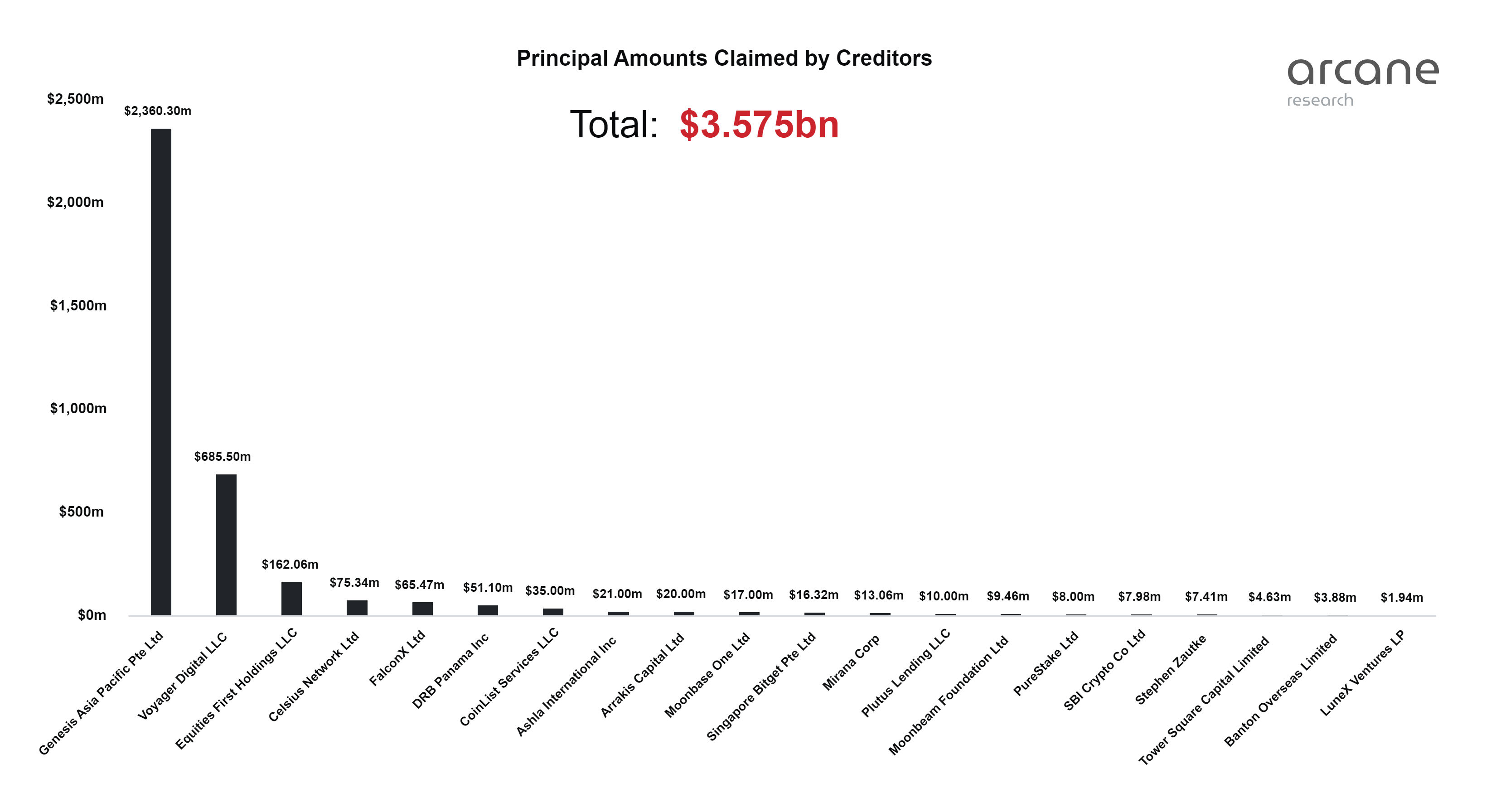

Effects

The liquidations of 3AC had a large impact on crypto lenders such as Block-Fi, Voyager and Celsius. Some even cause them to file for bankruptcy themselves.

Genesis: lent around $2.36 billion to 3AC

Voyager: lent around $650 million to 3AC

Block-Fi: Suffered huge losses after liquidating 3AC

Blockchain.com: lent 3AC around $270 million

Deribit: 3AC was an investor of DRB Panama causing them to file a liquidation application in the British Virgin Island

Source: https://arcane.no/research/236-237-btc-sold-by-known-institutions-in-the-last-two-months

Lessons learnt from the 3AC collapse: And the failure of 3AC can be related to:

Poor risk management and bad planning

As cryptocurrency is a highly volatile market, risk management, prudent planning and decision-making must be emphasized especially in a large hedge fund company like 3AC. The bull market might be easier to make money but whenever comes to the bear market, much more investment precautions must be taken.

Refusal to take the risks of algorithmic stablecoin seriously

3AC betted long on $LUNA and built their $UST position in Anchor Protocol which paid 20% APY with the loans. When they both collapsed, 3AC couldn’t pay their creditors.

#3 The bankruptcy of Celsius Network

Image Source: https://celsiusnetwork.medium.com/

Celsius Network?

Celsius Network is a crypto lending platform that has similarities with a traditional bank but instead, they are focusing on cryptocurrencies and operate like a hedge fund. It was founded by Alex Machinsky and S. Daniel Leon during the ICO boom of 2017.

A timeline of Celsius’s descent into Insolvency

In May 2022, the crash of Terra LUNA damaged the investors’ confidence in the market, causing a series of withdrawals on Celsius.

On June 12, Celsius posted a memo to inform their users that it had frozen their assets. The memo said withdrawals, swaps and transfers are frozen due to the “extreme market conditions”. In other words, depositors could not access their money anymore.

A month after pausing user withdrawals, Celsius lays off about 23% of its workforce as they facing huge liquidity issues.

On July 13, Celsius Network filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Southern District of New York. The company again came out with a statement to emphasize the importance of freezing users’ assets.

Celsius’s advisory partner revealed that Celsius has a $1.3 billion hole in the balance sheet on July 14.

Reasons for the bankruptcy of Celsius Network

High Yield = High Risk = Not Sustainable

Celsius offered crypto APYs as high as 18% while earning rewards in their own CEL token. However, Celsius invested their customer fund in high-risk De-Fi protocols such as Terra, Lido, BadgerDAO, Stakehound, etc. In May, the Terra LUNA collapse had damaged Celsius for sure.

Poor risk management

Again same as 3AC, Celsius did not put in place effective measures to mitigate the risks of price fluctuations that came with many of the investment strategies they used.

#4 The collapse of the FTX empire

Image Source: https://s3media.freemalaysiatoday.com/wp-content/uploads/2022/11/FTX.jpg

Is FTX a crypto or stock exchange?

FTX is a cryptocurrency derivatives exchange that offers futures, spot, and options markets for Bitcoin and a range of other cryptocurrencies. The exchange was founded in 2019 by Sam Bankman-Fried, the CEO of Alameda Research, a proprietary trading firm. FTX is headquartered in Hong Kong and has offices in San Francisco and New York. In addition to its core derivatives business, FTX also offers a cryptocurrency spot exchange, an index fund, and an over-the-counter (OTC) trading desk.

The relationship between FTX, FTT and Alameda Research

FTX and Alameda Research are closely related as they both were founded by Sam Bankman-Fried(SBF). FTX created a token called FTT.

It has several use cases, including:

Reducing trading fees on the FTX exchange

Providing white-label solutions

Providing a revenue share and token burn

Serving as collateral for futures trading

Offering additional gains to FTT holders

Determining the value of the FTT token

Allowing the creation of leveraged token listings

Alameda served as the main market maker for FTT, buying and selling a majority of the token. The popularity of FTT among FTX's investors, who were attracted by the trading discounts it offered, led Alameda to use its holdings as collateral for additional loans to support its trading activities. Alameda then found out that their assets consisted mostly of FTT which is illiquid.

A timeline of FTX collapse

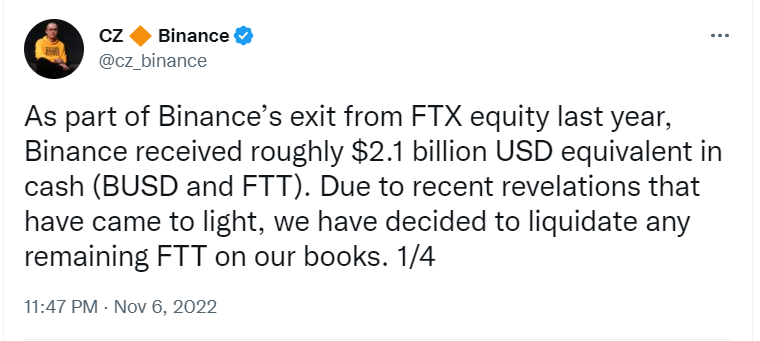

Nov 2: CoinDesk reported that much of the reserves of Alameda Research were FTT (FTX token) based on a leaked balance sheet of Alameda Research.

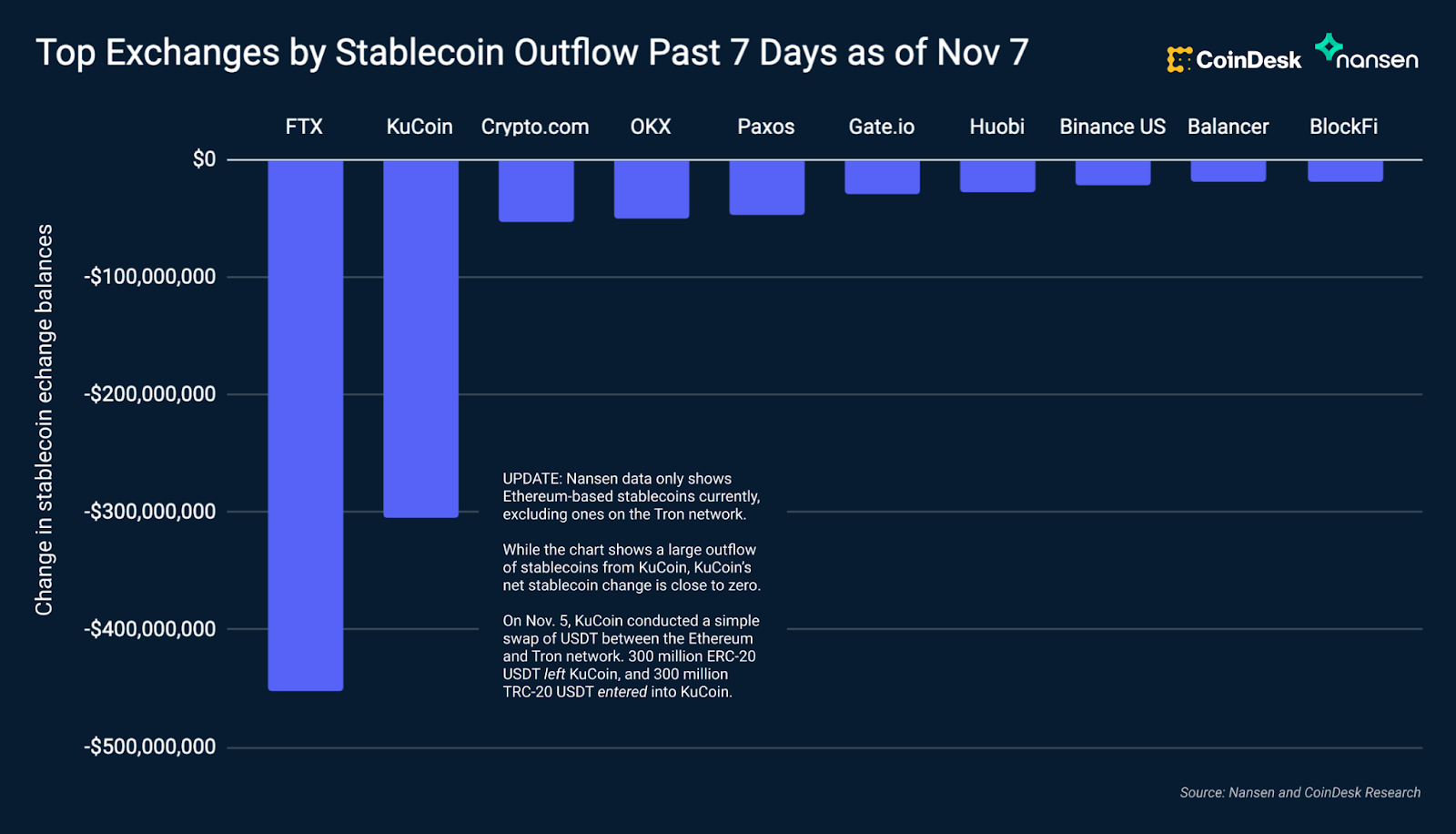

Nov 6: Binance CEO, CZ stated that their company planned to sell its FTT holdings which was an early investment by Binance in FTX back then. This caused billions in withdrawals from the exchange and the price of FTT started to fall.

Source: https://www.nansen.ai/research/blockchain-analysis-the-collapse-of-alameda-and-ftx

FTT price before and after FTX went bankrupt

Source: https://www.coingecko.com/en/coins/ftx-token

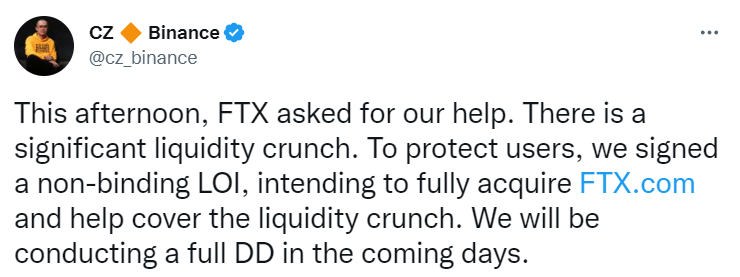

Nov 8: Binance showed their interest to acquire FTX

Nov 9: Binance decided to take off the deal of acquiring FTX

Nov 10: Bahamian financial regulator froze FTX’s assets

Nov 11: FTX filed for Chapter 11 bankruptcy protections. SBF stepped down from the CEO position

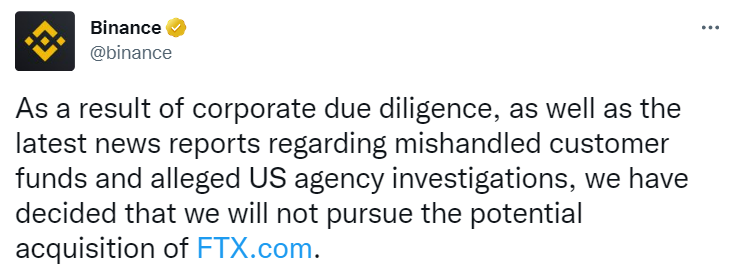

Dominoes effect of FTX collapse

The collapse of the FTX empire definitely caused a significant dominoes effect on the crypto industry, with around 260 million in the crypto market evaporated. The effects of FTX collapse can be summed up in the image below from CoinGecko.

Source: www.coingecko.com

Lessons learnt from FTX collapse:

Not your keys, not your crypto

In this downfall of the FTX empire, we finally realize the importance of self custodial wallet. Centralized exchanges are easier to use but you are not the one who is handling your money. There will be chances that exchanges will manipulate your funds to do something else. Putting your funds in a cold wallet might be much safer than putting them in a centralized exchange.

Beware of exchange tokens

Based on the research by Nansen, Alameda and FTX controlled the majority of FTT (around 90% of the circulating supply). This means that they can control the price of FTT causing FTT to spike or fluctuate. Alameda was most likely to use FTT as collateral to fix their liquidity issues during the Terra LUNA fallout. Therefore, investors must be very alert of the exchange tokens as they might be too “centralized” and controlled by a single party.

Integrity in the business

Normally, everyone on this Earth wants to get rich quickly and enjoy their lives. But as always, they forget integrity while doing business. FTX is a perfect example, they diverted customers’ funds to make investments, political donations, etc. When FUD came out and FTX didn’t have enough liquidity to process customers’ withdrawals.In short, don’t cut corners when doing business.

Decentralization matters

Centralized exchanges or any other centralized projects are more vulnerable to attacks. In Blockchain, decentralization is always one of the main points to discuss. This is the same thing in crypto as well, we are using crypto because we want to get rid of middlemen. So what’s the point of “Unbank yourself” to deposit your money into another “Crypto Bank”?

Conclusion

As we look back on the past year in the cryptocurrency market, it's clear that 2022 is a huge bear market for cryptocurrencies. Not only we saw some big crypto companies had gone bankrupt, but there were also quite a several big companies that filed for bankruptcy such as Voyager Digital, and Block-Fi which are not mentioned above. There were tons of cryptocurrency exploits and hacks in 2022 such as FTX, BNB chain, Ronin, Wormhole, Nomad and so on. In 2022, we did see a significant growth of NFT, Metaverse, Game-Fi and Fan tokens. Looking ahead to the coming year, it's difficult to predict exactly what will happen in the cryptocurrency market. For those considering investing in cryptocurrencies, it's important to conduct thorough research and carefully manage risk. As always, it's important to remember that investing in cryptocurrencies carries inherent risks, and it's essential to make informed decisions and carefully manage your portfolio. Good luck to you and your investing journey in 2023 🔥🔥.