What is tokenomics?

In the ever-evolving world of cryptocurrencies and blockchain technology, the concept of tokenomics plays a crucial role in shaping the success and value of a digital asset. Tokenomics refers to the economic principles and mechanisms governing a token's supply, demand, and distribution within a decentralized ecosystem. In this article, we will delve into the fundamental components of tokenomics, focusing on the correlations between supply and demand.

Binance Research

Tokenomics can be defined as the study of determining and evaluating the economic characteristics of a cryptographic token.

CoinGecko

Tokenomics is generally a broad term describing cryptocurrency's demand and supply characteristics. It encompasses everything about the mechanics of the crypto coin, including the token’s supply, the mechanics of how the cryptocurrency functions, as well as the behavioural and psychological forces that may affect its long-term value.

CoinMarketCap

The topic of understanding the supply and demand characteristics of cryptocurrency.

The correlations between supply and demand

Supply

Tokenomics begins with the token's supply, which refers to the total amount of tokens in existence or the maximum number that will ever be minted. Unlike traditional fiat currencies, many cryptocurrencies have predefined and transparent supply structures. Some tokens have fixed supplies, while others may have inflationary or deflationary mechanisms built into their protocols. The token supply can directly influence the token's scarcity, value, and distribution.

Allocation

The purpose is to show how much tokens are split among different parties

Few key allocation parties such as Founder/Core Team, Private Investor etc.

Token allocation might be very important

To avoid centralization risks

To understand how many tokens will be allocated to the communities, early adopters or developers

Example of Polygon Matic token allocation (Source: CoinGecko):

The initial distribution of Polygon (MATIC) tokens is as follows:

12.00% is allocated to Staking Rewards

23.33% is allocated to the Ecosystem

21.86% is allocated to Foundation

4.00% is allocated to Advisors

16.00% is allocated to the Team

3.80% is allocated to Private Investors

19.00% is allocated to Binance Launchpad

Vesting

The purpose is to restrict the token sale after the initial distribution

It's very common for projects' tokenomics nowadays

Vesting might be very important:

To prevent large fluctuations in price

Investors are able to avoid fluctuations during the token unlock date

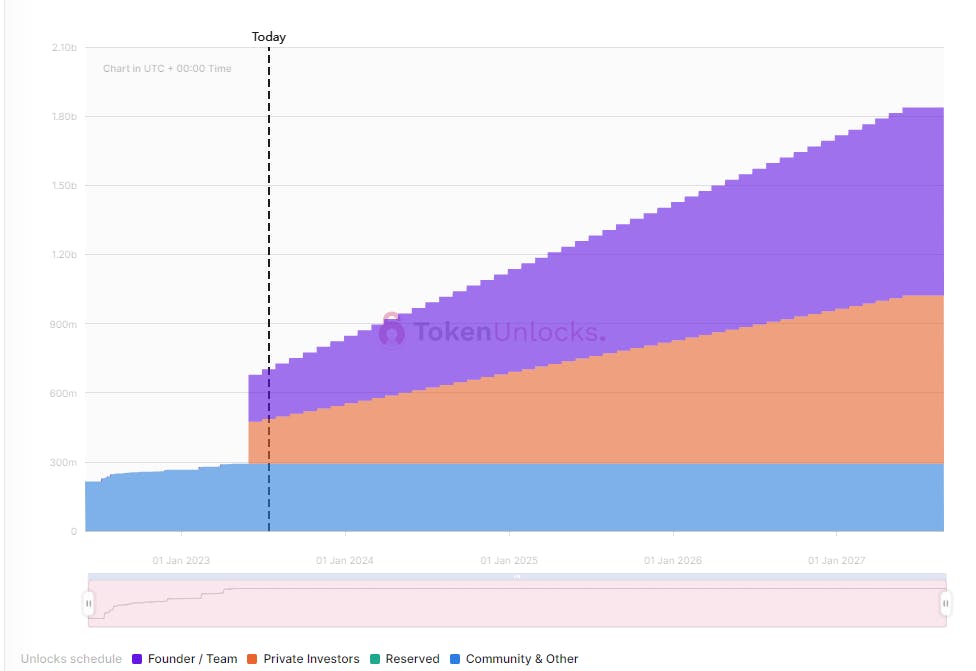

Example of Optimism OP token unlock schedule (Source: Token Unlocks):

Emissions

It simply means a crypto token releasing rate

It is useful to determine whether a token is inflationary or deflationary

Token emission increases will significantly

Projects might implement the burn mechanism to control the supply of their tokens

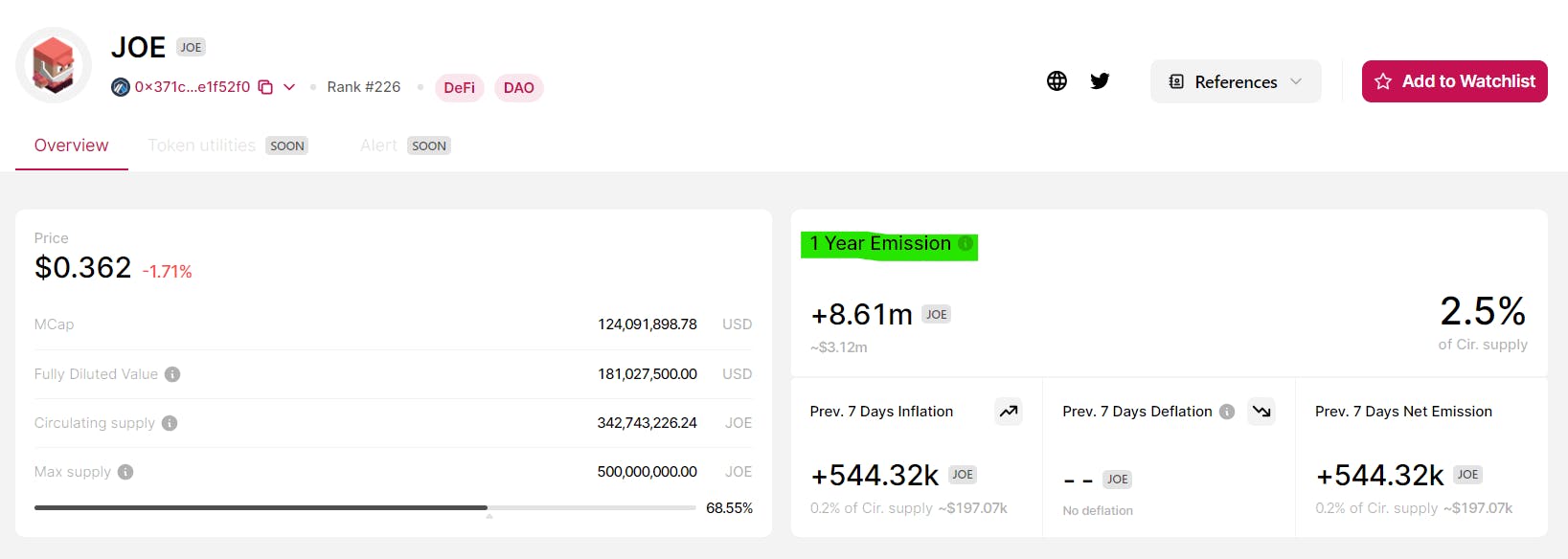

Example of Trader Joe Joe Token 1-Year Emission & Emission Rate (Source: Token Unlocks):

Airdrops

A way of token distribution methods

The airdrop is typically conducted by a blockchain or project to incentivize users by distributing free tokens to the early users' wallets

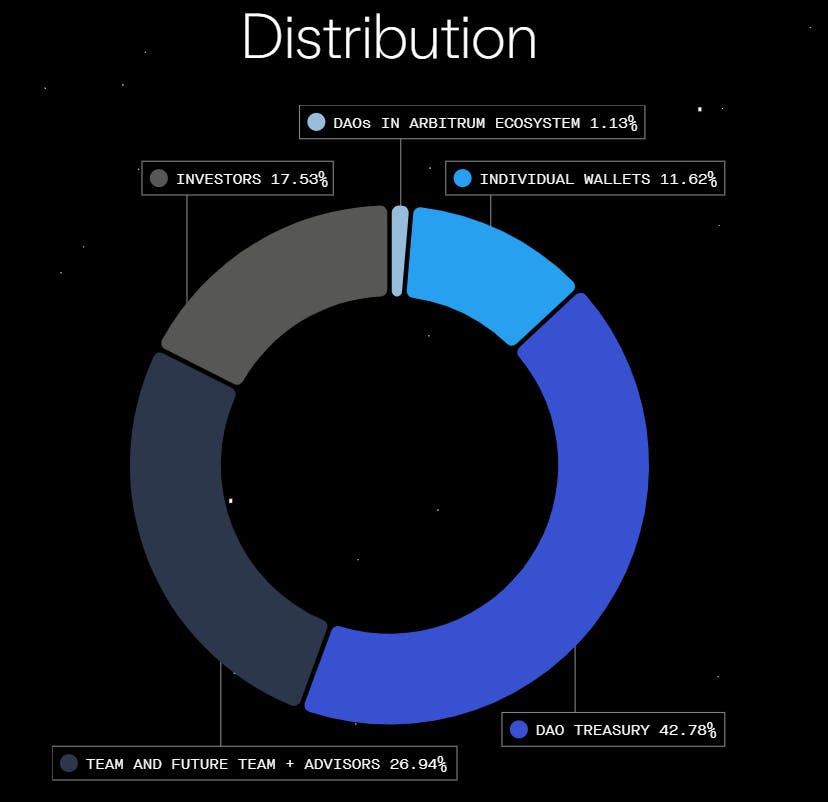

Example: Arbitrum allocated 11.62% of the token supply to the individual wallets (airdrops)

Demand

The demand for a token is determined by various factors, including its utility, functionality, and perceived value within the ecosystem it operates. Token demand can be driven by factors such as transactional purposes, access to services or products, governance rights, or speculative investment. The demand for a token often correlates with its adoption and popularity within the broader market. As demand increases, the token's value tends to rise, creating a positive feedback loop that can attract further interest and investment.

Utilities

The most important element in token demand

What's the purpose of having this token?

A token without any utilities can be called a "meme coin"

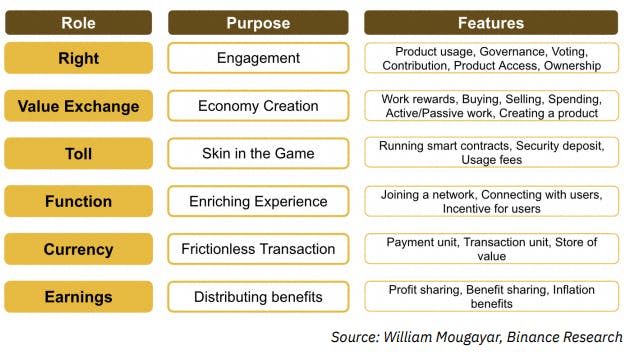

Right, Value Exchange, Toll, Function, Currency, Earnings

Governance

Tokens are used to govern the protocol through a DAO (Decentralized Autonomous Organization)

Token holders will not choose to vote on proposals that will destroy their own wealth

Transparent and healthy governance can offer a lot of utility and drive the demand for a token

Tokenomics details on CoinGecko

Market Cap: Total market value of a cryptocurrency’s circulating supply

Fully Diluted Valuation: Total market value of a cryptocurrency’s maximum supply

Market Cap/FDV: The proportion of current market capitalization compares to market capitalization when meeting max supply

Circulating Supply: The number of coins that are circulated in the market

Total Supply: The number of coins after deducting the coins that have been removed from circulation (Burned🔥)

Max Supply: The maximum number of coins ever created/coded to exist

Project Tokenomics Analysis

Ethereum

| Tokenomics Details | ETH |

| Market Cap | 230,072,604,891 USD |

| FDV | 230,072,604,891 USD |

| Circulating Supply | 120,201,013 ETH |

| Max Supply | Unlimited |

| Emission | Deflationary due to high network activity, amount of ETH burned > issued |

| Use Cases | Gas fees, Store of value and etc. |

Ethereum exhibits strong tokenomics fundamentals, with a significant market capitalization and a deflationary emission mechanism. Ether serves as a store of value and has various use cases within the Ethereum ecosystem, including gas fees and participation in GameFi, DeFi and NFT platforms. However, the unlimited maximum supply poses considerations regarding scarcity and potential inflationary effects. Nevertheless, Ethereum's strong adoption, developer activity, and expanding ecosystem make it a leading blockchain platform.

Arbitrum

| Tokenomics Details | ARB |

| Market Cap | 1,670,250,000.00 USD |

| FDV | 13,100,000,000.00 USD |

| Circulating Supply | 1,275,000,000.00 ARB |

| Max Supply | 10,000,000,000.00 ARB |

| 1-Year Emission | 1.48 billion ARB (116.3% of circulating supply) |

| Use Cases | DAO Governance |

ARB's tokenomics present a mixed outlook. On the positive side, the MC/FDV ratio suggests that the current market capitalization is relatively lower than the fully diluted valuation, which is favourable. The circulating supply percentage indicates a relatively small proportion of tokens in circulation, hinting at potential scarcity and value appreciation. However, the relatively high annual emission percentage raises concerns about increased inflationary pressure, which may impact the token's value over time.

Dogecoin

| Tokenomics Details | Doge |

| Market Cap | 9,812,057,451.04 USD |

| FDV | 9,812,054,651.80 USD |

| Circulating Supply | 140,210,306,383.71 doge |

| Max Supply | Unlimited |

| 1-Year Emission | 5.07 billion doge (3.6% of circulating supply) |

| Use Cases | N/A (Memes, Elon Musk's favourite coin) |

Doge, with a significant market capitalization, has established itself prominently in the cryptocurrency market. However, its unlimited maximum supply poses challenges to the token's scarcity and potential value appreciation. The substantial circulating supply and a relatively high 1-year emission rate of 5.07 billion Doge (representing 3.6% of the circulating supply) contribute to increased inflationary pressure.

Closing Thoughts

In conclusion, tokenomics is crucial while performing fundamental analysis.

However, there are several things that investors should emphasise on while "DYOR":

Focusing on the underlying product or service rather than the token itself

Understanding the true purpose behind purchasing a token

Evaluating the token utility within the project ecosystem

Considering supply and demand dynamics as a primary factor

Prioritizing long-term growth over short-term gains

By considering these aspects, investors can navigate the cryptocurrency market with confidence, making informed decisions that align with the fundamentals of the project.